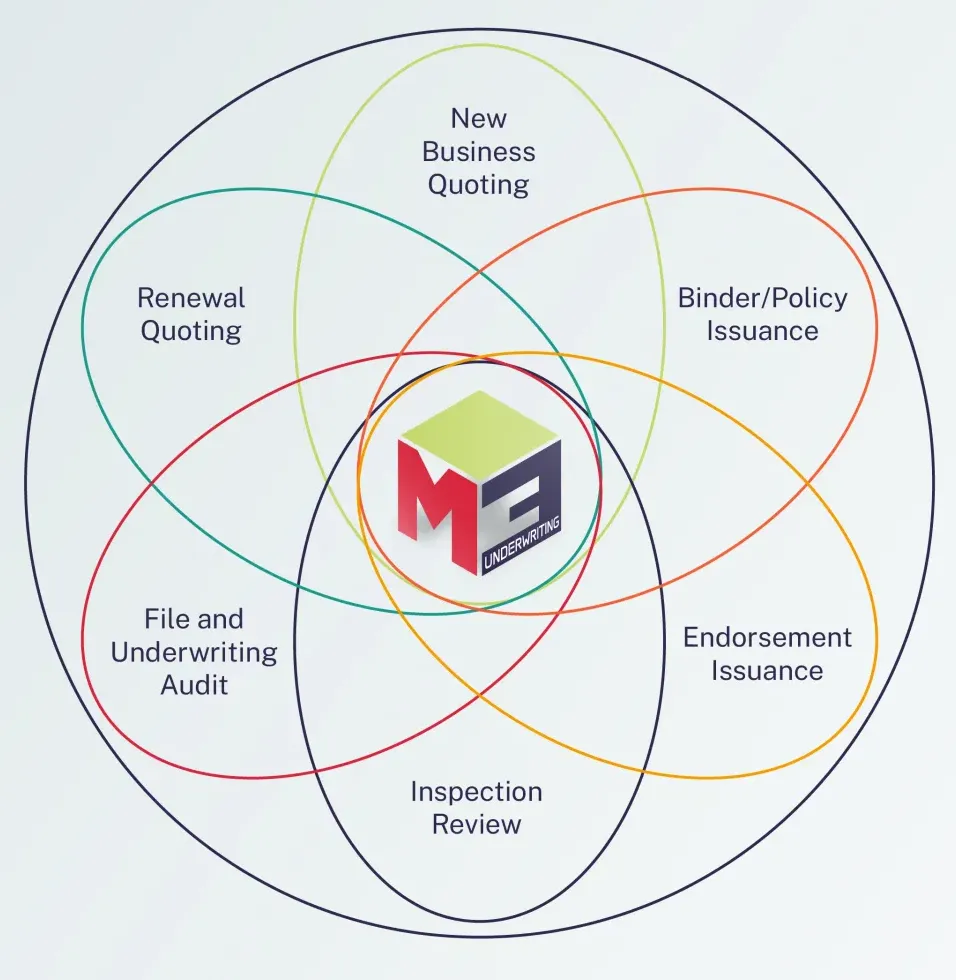

THE BEST CLIENT

EXPERIENCE THROUGHOUT

THE COMPLETE POLICY LIFE CYCLE

Building a company in the insurance industry is extremely challenging. New or old, big or small, M3 Underwriting instantly provides the power and knowledge your company needs.

In the automated systems era, the focus shifts to complicated processes and providing professional and more personalized assistan.

We are purely driven by quality, offering high-level end-to-end underwriting support and services while nurturing relationships and trust with our clients.

WE BRING QUALITY TO QUANTITY

Quote

Bind

Issue

Inspect

Audit

Service Quality & Streamlined Operations

At M3 Underwriting, we create, implement, and follow procedures, enabling consistency in providing high-quality services and decreasing the time required to service an account. With our streamlined processes and meticulous planning, we always transcend expectations and stay ahead of the schedule.

Incoming Tasks

758

Completed Tasks

758

Penidng Tasks

0

Predictable Expenses

Flexible Resources

Cost Optimization

Our versatile pricing models are designed to provide the best value for your unique business needs:

- Fully dedicated team

- Pay-per-task model that leaves no wasted resources

- Combined model, or

- Entirely customized solution for optimal impact.

Each pricing model offers tailored support designed to maximize your return on investment, with no additional charges and $0 fees.

Complete Application

Accurate Risk Assessment

Customer Allignment

Compliance

Risk Mitigation

Inadequate staffing is a leading cause of E&O claims, as high workloads often force employees to take shortcuts. To minimize your E&O exposure and gain a competitive edge, we provide experienced underwriters, underwriting associates and assistants who possess the skill sets to do the job correctly and completely.

Industry Knowledge & Expertise

Understanding the coverage and insurance processes is now more important and complex than ever. It is crucial to be clever with forms and endorsements available to tailor the coverage to meet the specific insureds’ needs or to eliminate coverage for exposures that underwriters aren’t willing to insure. Our in-depth industry knowledge provides a strategic advantage and ensures the final product consistently aligns with the intended coverage and established guidelines.

Strategic Alliance

Proactive Strategy

KPI Monitoring

Quality Reporting

Productivity Analysis

Trust & Transparency

Your goals are our mission and we will help you achieve them. However, success relies on a continuous flow of information. Our frequent reports and in-depth analysis provide a clear overview of your investment, building trust and guaranteeing complete clarity at every step.

Quality

Productivity

Profitability

Capacity

Reduced Turnaround Time

Improvement & Innovation

Scalability

Best Practices

Flexibility

Controlled Cost

Immediate Team Access

With instant access to our experts, you will save time and resources needed for hiring, training, and onboarding. Our specialized teams are available immediately and ready to seamlessly integrate into your workflow. Whatever your needs may be regarding insurance transactions, we will devise a perfect strategy to help you succeed and meet the rising customer expectations.

Proactive

Tailored

Efficient

Accurate

Personalized Support

WHO WE WORK WITH

MGAs

Wholesalers

Carriers

Program Managers

Program Administrators

Inspection Companies

Claim Adjusters

Retail Agents

Others

YOU CAN START

YOU CAN START

RIGHT NOW